Application of AI In Finance

Artificial Intelligence (AI) is used in different industries. It is also important in the finance department.

AI has made big progress in changing how banks and other financial companies work. It has helped them become more efficient, accurate, and able to provide personalized experiences to their customers.

In this article, we will discuss the applications of AI in finance, from fraud detection and risk management to algorithmic trading and chatbots. Let’s discuss the different aspects of AI in finance.

Applications of AI in Finance

Different applications of AI in finance are given below:

Fraud Detection

In the world of finance, it is very important to find criminals who try to cheat people and banks. AI helps a lot with this by looking at huge amounts of information and finding tricky patterns that people might not notice.

It uses special computer programs to immediately find strange things, like strange actions or suspicious money moves. When AI finds something fishy, it tells the people in charge so they can investigate further.

By using AI to catch fraud, banks and other financial institutions can prevent bad things from happening and keep everything safe and fair.

Customer Service

AI chatbots are super popular in banks because they give fast and personal help to customers. These computer helpers can answer questions, tell you how much money you have, show your past transactions, and even give simple advice.

Banks can be faster, save money, and make customers happier by using chatbots. The chatbots are smart, can understand what you’re asking, and can give you the right answer.

Algorithmic Trading

Algorithmic trading has changed the financial markets, and AI plays a vital role in making it possible. By using complex algorithms and machine learning models, AI systems can analyze vast amounts of financial data, identify trends, and execute trades with minimal human intervention.

These algorithms can make split-second decisions based on market conditions, historical data, and predefined strategies. Algorithmic trading powered by AI has the potential to enhance market liquidity, reduce transaction costs, and increase efficiency.

Risk Management

Risk management is an integral part of the financial industry. AI can assist in assessing and managing risks by analyzing vast amounts of data and identifying potential threats.

Machine learning models can evaluate historical data, market trends, and external factors to predict risks accurately. AI-powered risk management systems can help financial institutions make informed decisions, minimize losses, and ensure regulatory compliance.

Portfolio Management

AI has changed how people manage their investments by giving them advanced tools to understand and improve their portfolios. With the help of special computer programs, AI can analyze the market, see how well different investments are performing, and suggest changes to improve the portfolio.

These programs can give quick advice, automatically adjust investments, and make portfolios perform their best. This way, investors can use data to make smart choices about their money.

Insurance Underwriting

Insurance underwriting involves assessing risks and determining policy terms and premiums. AI has significantly improved the efficiency and accuracy of underwriting processes.

Machine learning models can analyze vast amounts of data, including historical claims, demographic information, and risk factors, to make more precise underwriting decisions. AI systems can automate underwriting processes, reduce manual effort, and improve the speed and accuracy of policy evaluations.

Regulatory Compliance

The financial industry operates under strict regulatory frameworks to ensure transparency, fairness, and security. AI can assist financial institutions in ensuring regulatory compliance by analyzing large volumes of data and identifying potential violations.

Machine learning models can monitor transactions, detect suspicious activities, and generate alerts for compliance teams to investigate further. By leveraging AI for regulatory compliance, financial institutions can streamline their compliance efforts and reduce the risk of non-compliance.

Debt Collection

Debt collection is a challenging task for financial institutions, requiring effective strategies to recover overdue payments. AI can optimize debt collection processes by analyzing customer data, payment history, and engagement patterns to identify the most effective collection methods.

AI-powered systems can automate debt collection communications, personalize interactions, and prioritize collection efforts based on customer profiles and the likelihood of payment.

Travel & Expense Management

AI helps businesses simplify travel and expense management. It uses smart computer programs to analyze expense information and automatically identify patterns and categories.

This means less work for people, and it helps ensure everything follows the rules. AI also gives useful advice on improving travel and expense budgets.

Reduced Operational Costs and Risks

Using AI in finance can save money and make things safer. It can do jobs that people used to do automatically, meaning fewer mistakes and less money spent. AI can also find possible problems before they happen and tell the right people so that they can fix them quickly.

This helps keep everything running smoothly and reduces the chances of something bad happening.

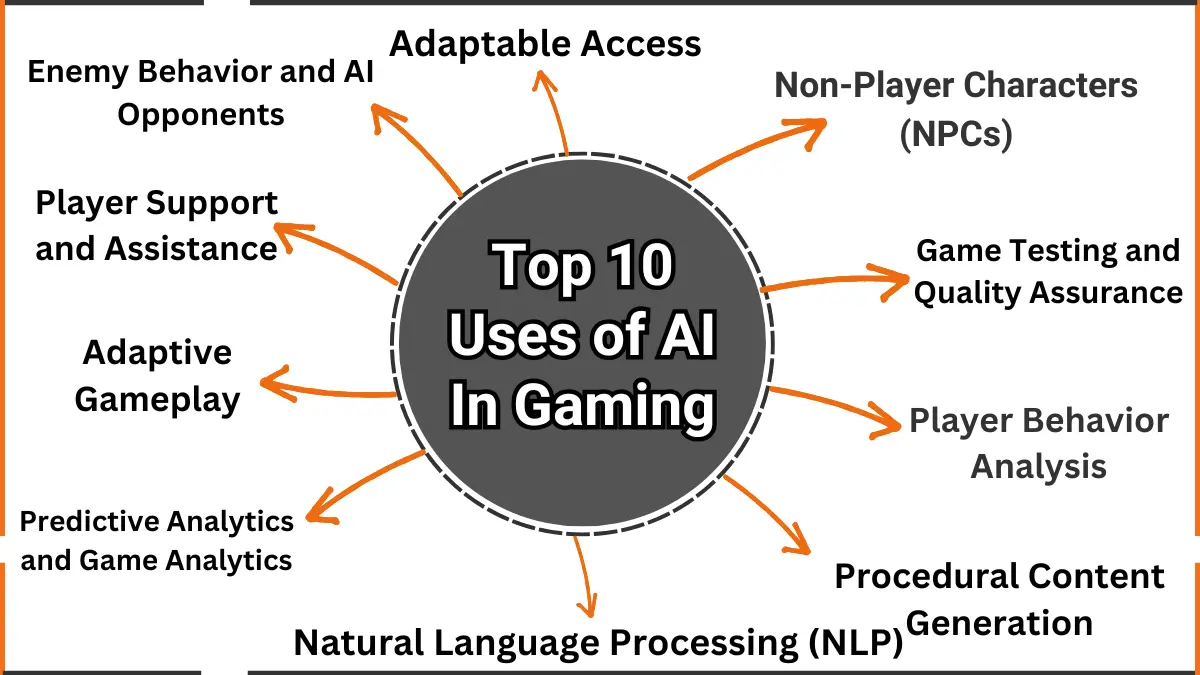

Chatbots

Chatbots have emerged as valuable tools for financial institutions. They provide round-the-clock customer support, personalized recommendations, and instant access to information. AI-powered chatbots can handle various customer inquiries, assist in transactions, and even offer basic financial advice.

By using natural language processing and machine learning algorithms, chatbots can understand and respond to customer queries effectively, enhancing the overall customer experience.

Document Analysis

AI helps banks and finance companies by reading and understanding documents well. It can take important information from things like contracts, bills, and financial papers, so people don’t have to do it manually.

This saves time and makes fewer mistakes. AI can also check if the documents follow the rules and have the right important words.

FAQs

How is AI used in fraud detection?

AI analyzes transactions in real-time to detect unusual patterns. It helps identify and prevent fraudulent activities.

Can AI help with customer service in finance?

Yes, AI-powered chatbots assist customers by answering queries, providing account updates, and offering financial advice.

Is AI used in personal finance?

Yes, AI powers budgeting apps and virtual advisors that help individuals manage spending and savings.

What role does AI play in cybersecurity for finance?

AI monitors systems for threats and strengthens security measures to protect sensitive financial data.

Leave a Reply